Web 3.0

- Richard M Hopen

- Mar 12, 2022

- 2 min read

Before explaining Web 3.0, let's take a quick look at the evolution of the web.

Web 1.0 was the internet from 1991 to 2004. Websites were essentially static pages. A user would log onto the internet and access information from a website.

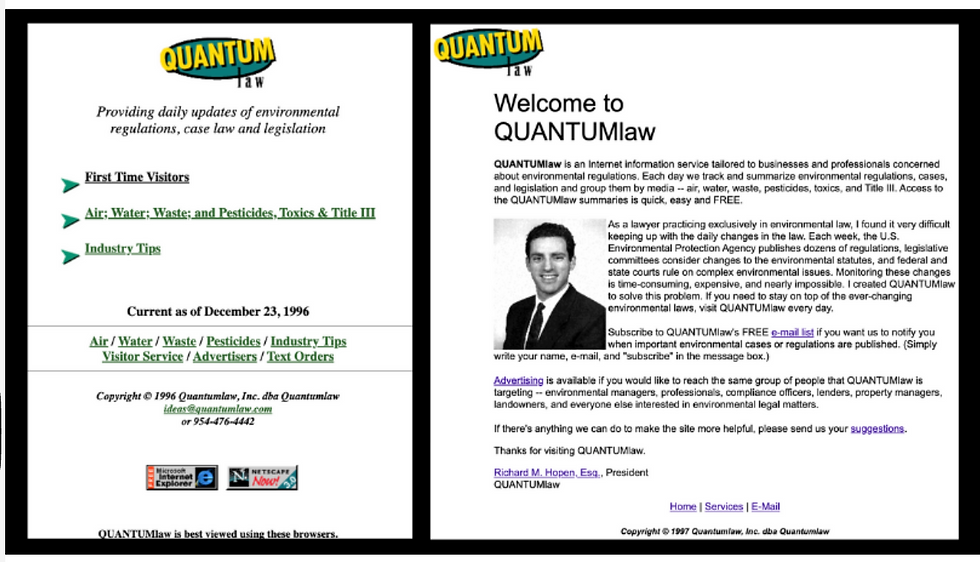

As an OG ("old guy," not "original gangster"), I remember the excitement of being one of the first environmental lawyers in the US to launch a website in 1996.

In 2004, Web 2.0 began and it ushered in the era of user-created content, the spark of social media.

A handful of large tech companies control the applications that allow us to engage with each other. Our likes, comments, and time we spend on their sites gives them access to how we think and feel. They monetize our personal data.

Over the last few years, we've seen the dark side of Web 2.0. There have been breaches of privacy, mis- and disinformation campaigns. Authoritarian governments have accessed this data, giving them power to manipulate public opinion.

Web 3.0 offers a solution to these problems that are founded on decentralization.

Blockchain technology will encrypt a user's data and distribute it over thousands of nodes. No company will be able to access or monetize the data.

Here's how Web 3.0 is taking shape.

▶︎ Decentralized Autonomous Organizations (DAO) are an alternative to incorporating. DAOs are organizations based on rules that are encoded into software and controlled by its members. There is no centralized leadership and its members own the DAO. The largest DAO by market cap is Uniswap ($5.6 billion).

Here's a fascinating example of how a group of like-minded people can come together to form a DAO.

In November 2021, ConstitutionDAO was created. Its purpose was to purchase an original copy of the US Constitution that Sothebys planned to auction. In just a few days, the DAO raised $43.2 million in ETH cryptocurrency. The DAO lost the bid and refunded the money to its members.

▶︎ Decentralized Finance (DeFi) allows users to exchange currency and financial instruments without banks, brokerages, or other financial organizations. Some examples for DeFi include asset management, payment solutions, peer-to-peer (P2P) lending and borrowing, and digital identity. The DeFi market cap is $71.8 billion. See DeFi Pulse for info and links to top DeFi platforms.

Comments